JPFL Films Pvt Ltd (Jindal), a flexible packaging giant which is a part of the BC Jindal Group, announces full capacity utilization for the capacitor film business. To cater to the growing capacitor market, the company is doubling its capacity. With a capex commitment of INR 250 crore by 2025, the company is capitalizing on the technical success of the films among various customers in India. The quick turnaround and success is also due to close working collaboration with its own group company Treofan GmbH, a long-standing trusted Gold Standard supplier to this industry.

It is with great pleasure that we acknowledged encouraging feedback from TDK corporation, one of the world’s largest electronic components manufacturers: “We would like to express our appreciation for the services and product quality you have provided so far. For our standard applications, your BOPP films have met our expectations, and we are pleased with the overall performance.”

JPFL has employed advanced machinery capable of modifying the film surface roughness on both sides and creating multiple metalizing patterns according to the end-customer needs. A distinctive feature of the capacitor films by JPFL is the film’s high breakdown voltage, a crucial characteristic that has shown consistent improvement through ongoing process refinements. The company also has world-class testing facilities including sophisticated pin hole testing to ensure that every product meets the highest standards of quality and reliability. The company offers all variants of PP based Capacitor films base films, Hazy films and Metalized Capacitor films. These metallized capacitor films can be manufactured in various patterns and designs, including impregnated films.

Sharing his views on the strategic expansion, Dr. Mahesh N Gopalasamudram, Dy CEO (Growth Division), JPFL put it in perspective, “This expansion is in line with our aim to contribute to the Make in India initiative of the government thereby reducing import dependency. With the help of advanced machinery and state-of-art testing facilities, we are working towards supporting the industry to become self-reliant and shorten developmental lead times. Supplying films with exceptional breakdown voltage, shorter lead time, robust supply chain and consistent quality is our commitment to the industry. Our enhanced capacity will ensure steady supply of locally manufactured world class technical films, supporting the growth of various industries, including electronics, automotive, and energy storage.”

This strategic expansion highlights the company’s commitment to technology, quality, cost optimization and innovation, leading to enhanced customer satisfaction. As the capacitor films market continues to evolve, Jindal is better equipped to meet the opportunities that lie ahead, reinforcing its status as an industry pioneer and reliable partner for businesses worldwide.

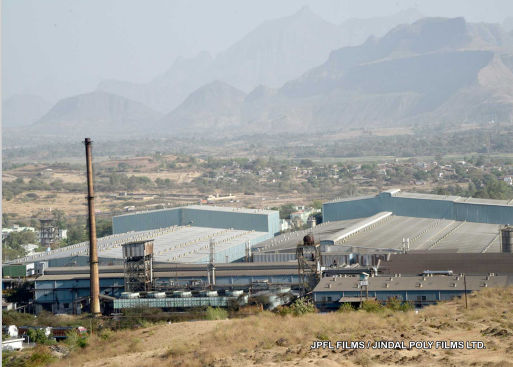

About Jindal Poly Films Ltd-

Jindal Poly Films (JPFL) started the flexible packaging films business in 1996 and has grown into a >USD 500 million turnover company with 2500+ workforce. JPFL focuses on building trust with and creating value for all stakeholders through its scale, innovation, advanced technologies and cost efficiencies. The company has demonstrated growth via the execution of capital-intensive projects and multiple acquisitions. JPFL Films, a key subsidiary, is the largest flexible packaging films manufacturer in India and provides a one-stop solution to its customers across all segments. Its Nasik Plant is the world’s largest single location facility for the manufacturing of flexible packaging films.

About BC Jindal Group-

The US$ 2.5 Billion B. C. Jindal Group is amongst India's leading business houses. Established in 1952, the group has a diverse workforce of more than 10,000 people across India, Europe and the US. Key business verticals include flexible packaging films, energy generation and downstream steel products. The Group has a continuous growth agenda with a successful track-record of executing capital-intensive projects & multiple global acquisitions.