AMI, Bristol, 19th July 2016 - AMI Consulting, a division of Applied Market Information Ltd., has just published a new report on the heavy duty sack market, analysing the latest trends in the use of polyethylene versus paper across the various end use sectors, along with developments in raw materials, extrusion technology and bagging equipment at the packing stage.

Heavy duty sacks are generally regarded as those that hold 25kg of product, although there are some exceptions. The year 2010 marked the point at which plastic sacks overtook paper sacks in terms of number of units, since then plastic's share has grown to almost 55% and is forecast to rise to almost 60% by 2020. Sacks are a significant segment of polyethylene packaging in Europe, accounting for a little over 7% of total polyethylene film production.

Why has there been such dramatic penetration of the total sack market at the expense of paper sacks in most of the end use sectors? The main reasons include the following: plastic sacks show improved 'stackability' which reduces storage space and transport cost as opposed to, for example, stand-up paper or woven sacks; they are lighter than their paper alternative and so can dramatically reduce the carbon footprint of the packaging; plastic sacks are 100% recyclable as opposed to paper sacks laminated with a plastic liner and they demonstrate 100% sealability giving rise to dust-free handling with no spillage or waste; additionally barrier properties can be built into the base film where required, e.g. to improve odour or moisture barrier.

The plastic heavy duty sack sector has always made good use of newly developing raw materials: first butene linear resins, then the higher alpha olefins and, more recently, metallocenes to allow a continual process of product improvement and material downgauging. Major thickness reductions took place at the turn of the millennium then during the period 2006-2010, however further thickness reductions have continued to take place, but at a slower pace.

LDPE remains the major polymer used in the production of heavy duty sacks at a little over 50%, followed by HDPE/MDPE, butene, octene then metallocene. Bimodal HDPE and metallocene resin show the highest growth rates, although from a much lower base.

Advances in form-fill-seal (FFS) machinery will continue to create further opportunities for plastic industrial sacks to displace multi-wall paper sacks in their existing stronghold areas, such as powder products (e.g. cement), food and pet/animal feed. Although cement products account for almost one third of all sacks used in Europe, demand for cement plastic sacks is the smallest segment – as over 90% of cement products are packed in paper sacks rather than PE. Cement is normally hot filled at between 90° and 110°C which has made it extremely challenging for plastic film to compete with paper. Additionally, with cement being a very fine powder, it makes it very difficult to extract air from a plastic sack, while paper has sufficient permeability to permit de-aeration after filling. Finally, the cost of plastic sacks is slightly higher than that of paper sacks and, with cement being a relatively low cost item, it is difficult to justify expenditure in alternative wrapping equipment. However, the problems of packing fine powders using plastic have been largely overcome, so that technically there is no barrier to change.

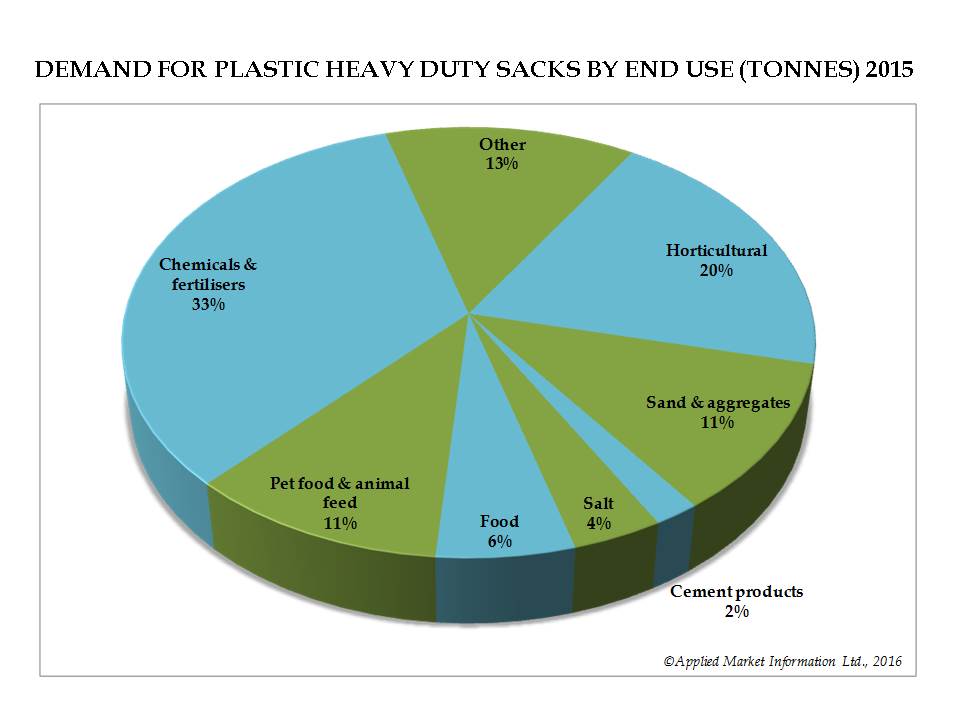

The largest end use markets for plastic sacks are chemicals and fertilisers, accounting for one-third of European demand, and horticultural products, accounting for 20% of demand. In the case of chemicals, often only a simple print is required for product identification; in the case of horticultural products and some fertilisers, high quality flexographic print up to 10 colours is the norm, in order to produce an eye-catching impression at point of sale of what is essentially a consumer-aimed market segment. Plastic sacks also hold a dominant position in sectors such as sand & aggregates and salt, at 90% plastics penetration – these end uses require only simple or no print. Food packing in plastic heavy duty sacks is a relatively fast-growing sector, driven by increasingly strict requirements on paper sacks in terms of food contact compliance and the risk of contamination by paper fibres.

The plastic heavy duty sack market is fairly fragmented with a high number of producers. However, there are six major producers with a combined annual production of a little under 200,000 tonnes: Armando Alvarez Group, Bischof + Klein, British Polythene Industries, Nordfolien, Oerlemans Packaging and RKW.