Shipping disruptions in the Red Sea have significantly affected supply chains, leading to price increases for European flexible packaging materials in the first quarter of 2024.

In the initial quarter of 2024, prices for nearly all types of flexible packaging materials experienced slight increases compared to the end of 2023, primarily due to disruptions in resin and film supply caused by security issues in Red Sea shipping. Demand across all material markets remained stable.

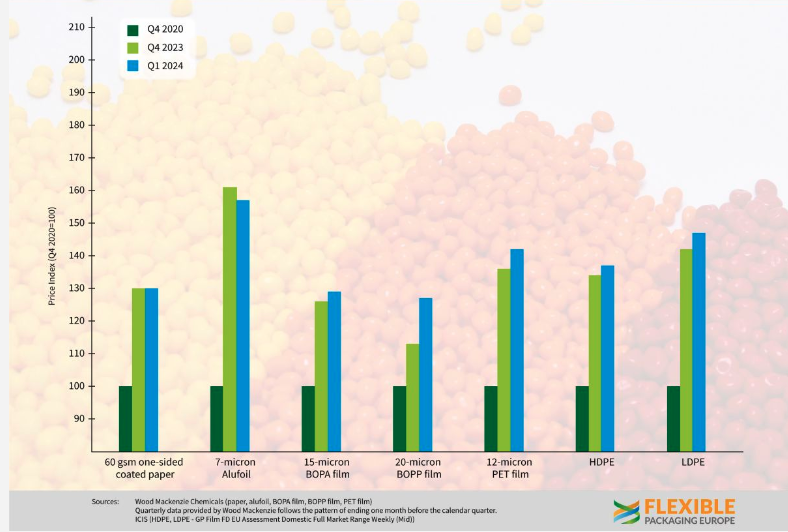

HDPE and LDPE continued their gradual upward trend observed in the latter half of 2023, with increases of 2.3% and 4.1%, respectively. 20-micron BOPP film surged by 12%, reaching prices last seen in Q2 of 2023. Meanwhile, 15-micron BOPA film saw a more cautious 2% rise, and 12-micron PET increased by 4%, nearing its early 2023 price. Only 60gsm one-sided coated paper maintained stability, showing no change compared to the final quarter of the previous year.

While prices remain below the levels seen at the beginning of 2023 across the board, aluminum foil and 60gsm one-sided coated paper experienced the most significant declines, down by 16% and 24%, respectively. However, compared to Q1 2020, prices are notably higher, ranging from 27% (BOPP) to 57% (aluminum foil).

According to Santiago Castro of Wood Mackenzie, prices for flexible packaging materials in Europe mostly increased in Q1 2024, with BOPET, BOPA, and BOPP seeing the most significant rises. Paper prices remained stable, but an increase is anticipated in Q2 due to rising pulp costs. Aluminum foil prices decreased further due to reduced conversion costs. While overall demand has improved due to restocking, end-user demand remains weak, although signs of improvement are emerging.

Guido Aufdemkamp, Executive Director of FPE, noted increased market uncertainty compared to the end of the previous year. Escalating tensions in the Middle East and ongoing shipping threats in the Red Sea have disrupted supply chains significantly. The war in Ukraine also continues to impact both supply and European demand for packaging materials and goods. However, extreme destocking appears to have ended in most segments, with restocking at a more normal level underway. With cautious demand upturns and stabilized prices, the European flexible packaging materials market may see modest growth later in the year.