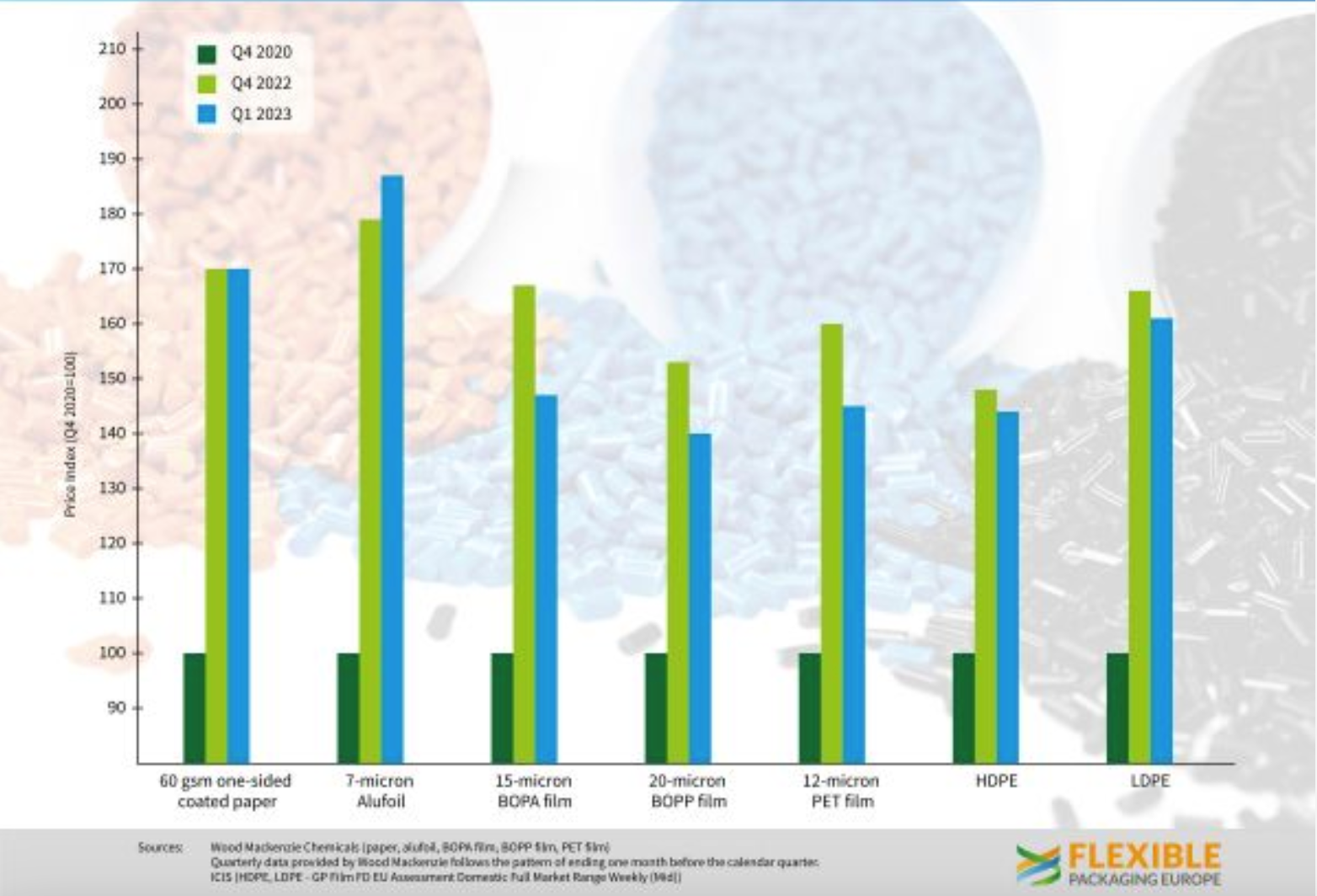

Following the first signs of cooling prices for flexible packaging materials seen at the end of 2022, the first quarter of 2023 saw a drop across the basket of materials, with only aluminium foil ticking up further (from 179% to 187% v Q4 2020)* due to higher conversion costs. Only 60gsm one sided coated paper remained stable at 170%, v Q4 2020. Other materials such as 15-micron BOPA film at 147%, 12-micron PET film at 145% and 20 micron BOPP film at 140% recorded minor recent price declines of up to 12% and remain well above Q4 2020 price levels, according to figures released recently by Flexible Packaging Europe (FPE).

Both LDPE and HDPE recorded much smaller recent price reductions, both at -3%. They now stand at 161% (LDPE) and 144% (HDPE), well above 2020 levels, having been as high as 201% and 182% in the middle of last year.

David Buckby, senior analyst at Wood Mackenzie commented, “Our overall basket of raw material prices fell in Q1 2023 compared to the previous quarter. However, reductions were not applied across the board and prices remain substantially elevated compared to 2020 levels.”

“BOPP, BOPET and BOPA films all saw quarterly reductions of approximately 10%. Order volumes by converters were lower than usual as they continued to work down high inventories, a process which is being slowed by weak consumer demand. One-side coated paper prices were stable, halting a run of seven consecutive quarterly hikes. Declining pulp and energy costs coupled with soft demand could well lead to reductions in Q2. Foil pricing saw a slight uptick in Q1, driven mainly by higher conversion costs,” he added.

According to Guido Aufdemkamp, Executive Director of FPE, the figures reflect some good news but also added a note of caution, “While the majority of flexible packaging material prices have declined slightly, they are still at very high levels compared to the pre-Covid market. This decline is partly to do de-stocking along the whole value-chain, as well as weaker end-consumer demand. If inflation remains high consumers will likely remain cautious and even though many economists expect the rate of inflation to fall at the end of 2023, there is a lot of uncertainty across all business sectors. One piece of good news is that energy costs are falling, which can have a beneficial effect on overall price levels. These different factors are pulling the market for flexible packaging materials in different directions, so we will have to wait to see how the different end-markets develop over the year.”

*All comparisons are with Q4 2020 as a base at 100%.