For more variability - the TURBOVAC i/iX family grows

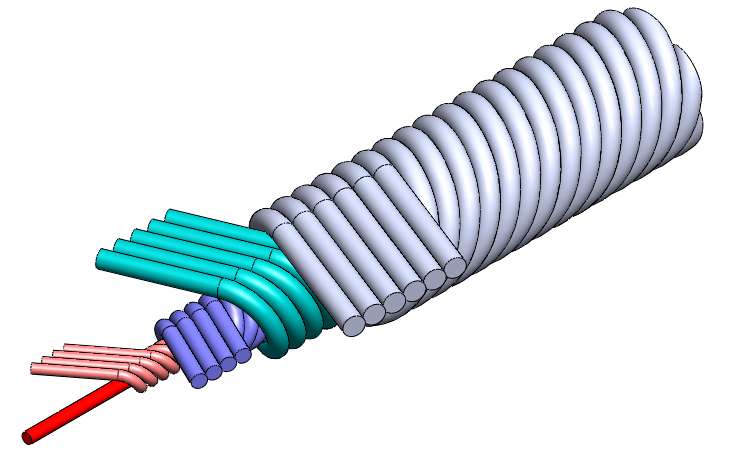

Cologne, June 2020 – In June 2020 the vacuum specialist Leybold has expanded its TURBOVAC i/iX series - 90, 250, 350 and 450 - by the sizes 850 i/iX and 950 i/iX to six models. The two new turbomolecular pump variants are characterized by extended, trouble-free operation, longer system life and lower operating costs. They are used in many applications from research and development and analytics to industrial. In other words, especially where a clean and stable high- and ultra- high vacuum is required – such as in coating, heat treatment, analysis, thin-film research and helium recovery.

Significantly higher productivity Basically, the new members of the TURBOVAC i/iX family provide significantly improved vacuum performance in a wide range of applications. Especially due to the expansion of the family in the direction of higher pumping speeds and compression values, lower service costs and simple, intuitive operation. In some applications, the integration of the new 850 i/iX and 950 i/iX models will even lead to a significant reduction in the number of pumps and thus in the total life cycle costs.

Mountable in any orientation These options are also useful for another reason: Each vacuum application has different installation conditions. This requires flexible installation directions, for example when there is little space for vacuum pumps, as is the case when integrating them into compact, industrial pumping system solutions. Here too, the TURBOVAC i/iX series, with its various models and variants in terms of pumping speeds or compression ratios, is one of the most flexible systems on the market for high-vacuum products and can be mounted in any orientation.

Flexible integrated drive electronics Especially in order to promote sales in the industrial and coating market, EthernetIP, EtherCAT and Profinet Anybus options are now added to the existing Profibus, RS232 and RS485 communication modules. They are all available as IP54 versions. The EthernetIP, EtherCAT and Profinet modules have an integrated web server.

TURBO.CONTROL i The entire TURBOVAC i/iX series can be controlled and monitored via the TURBO.CONTROL i. The advantage of the controller is that it is equally suitable for integration in high-vacuum applications and compact system solutions. Its application is uncomplicated: It can be operated intuitively via the display and front keys or via a web server interface. The web server allows all pump parameters to be easily monitored and set via PC or mobile device.

Cost effective maintenance with very long intervals Last but not least, the maintenance-free and oil-free hybrid bearing concept ensures greater reliability and a longer service life: On the high-vacuum side, the rotor of the turbomolecular pump is guided in a wear-free magnetic bearing, while a ceramic ball bearing lubricated for life is integrated on the backing side, which users can replace themselves on site if necessary.

For further information, please contact:

Séverine Grimberg Global Communications Coordinator

Scientific Vacuum Division Atlas Copco Vacuum Technique

Bonner Strasse 498 50968 Cologne

Phone: +49 221 347 1211 –

Mobile: +49 160 91556457

E-mail:

severine.grimberg@vt.atlascopco.com

About Leybold

Leybold is a part of the Atlas Copco’s Vacuum Technique business area and offers a broad range of advanced vacuum solutions for use in manufacturing and analytical processes, as well as for research purposes. The core capabilities centre on the development of application- and customer-specific systems for the creation of vacuums and extraction of processing gases. Fields of application are secondary metallurgy, heat treatment, automotive industry, coating technologies, solar and thin films such as displays, research & development, analytical instruments, food & packaging, as well as a multitude of other classic industrial processes.

About Atlas Copco

Great ideas accelerate innovation. At Atlas Copco, we have been turning industrial ideas into business- critical benefits since 1873. By listening to our customers and knowing their needs, we deliver value and innovate with the future in mind. Atlas Copco is based in Stockholm, Sweden with customers in more than 180 countries and about 37 000 employees. Revenues of BSEK 95/ 9 BEUR in 2018.

For more information:

www.atlascopcogroup.com