Sustainability regulations for packaging have become increasingly ambitious. A detailed understanding of the diverse regulatory landscape will be essential for companies to remain compliant.

Sustainability in packaging is a megatrend shaping the packaging industry, with consumers becoming increasingly worried about the environment and the impact of packaging leakage.1 In response, new, stricter sustainability regulations are emerging on multiple fronts with increasing frequency. However, regulatory focus and approaches vary considerably by region and diverge even further when viewed at the country or state level. This heterogeneity is making the fast-changing regulatory landscape complex to navigate on a worldwide basis. To better understand the recent developments, we have mapped regulations in 30 countries around the world. Our findings reveal several common patterns of development that can be represented by four archetypes globally. To ensure they comply with the evolving requirements, packaging companies should stay tuned to regulation developments in sustainability packaging by tracking changes in their focus markets and implement processes to address future requirements proactively

Increasing pace of regulatory development

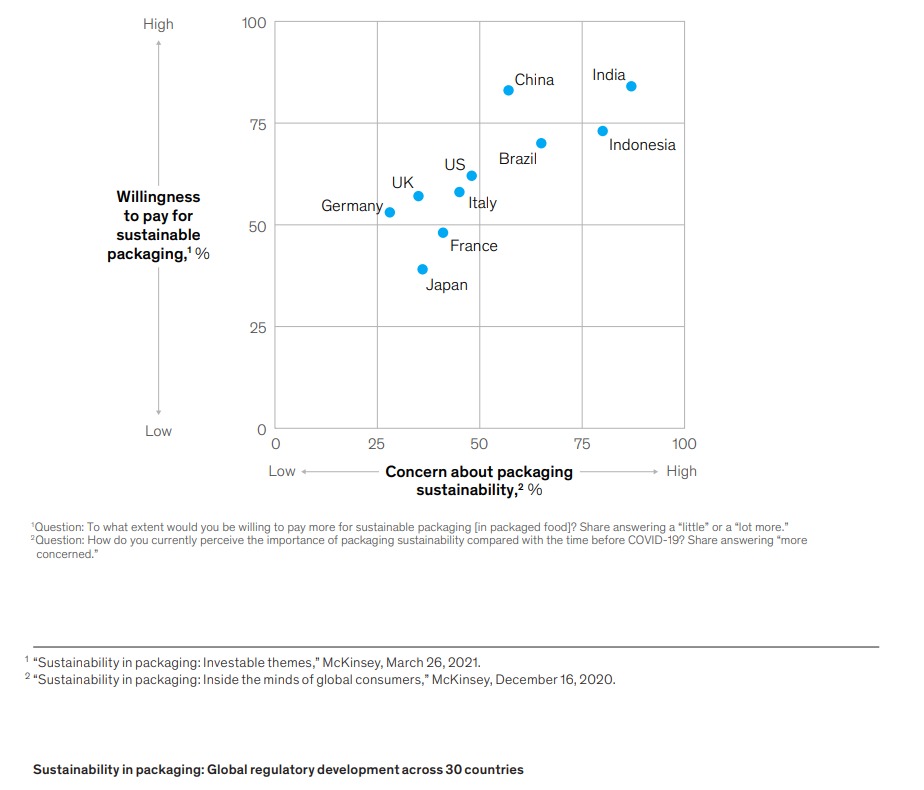

Pressure to reduce packaging waste has increased dramatically in the face of global consumer sentiment aroused by visceral images of packaging leakage into oceans (Exhibit 1)—and regulators are responding to address the public outcry.2 In

Globally, the vast majority of consumers are highly concerned about packaging sustainability and express a willingness to pay more for sustainable packaging

Share of survey respondents, selected countries, %

In recent years, we have seen a rapid increase in sustainable-packaging regulations well beyond a focus on shopping bags and selective food-service items.

recent years, we have seen a rapid increase in sustainable-packaging regulations well beyond a focus on shopping bags and selective foodservice items.3 It is critical for companies across the packaging value chain to be aware of the accelerating pace of regulatory development, as noncompliance could lead to the imposition of tax increases or penalties. However, understanding the developing regulations on a global scale is highly complex given the following factors:

— Regulatory maturity across countries is extremely heterogeneous.

— Established or aligned terminology is not in place globally—for example, the term recycling can have different meanings, leading to variable intensity of impact for the industry.

What is in scope varies. For example, some regulations are focused on multiple categories, applications, end products, and materials, while others focus on specific aspects—this creates potential overlap with different regulations covering a similar scope

— Regulations are still in early stages of development, leading to uncertainty around undefined scopes, action plans, or targets.

— The geographical picture is complicated, as regulations can be developed at a federal, state, or even city level

To better understand the developing picture, we have mapped current and proposed regulations in 30 countries around the world. This covers all regions: Europe and the European Union (eight countries), North America (three countries), Latin America (four countries), Asia (seven countries), and the Middle East and Africa (eight countries).

Mapping regulatory development across 30 countries

It is clear that there has been a general awakening on the issue given that 29 out of 30 countries studied have started to discuss and implement sustainable-packaging regulations. As expected, these regulations are intended to enforce new requirements with the principal aim of limiting the negative impact of packaging on both the environment and on human health. Most regulations across the countries studied also tackle the following end-to-end elements:

— packaging specifications (such as composition, size, and weight)

— attributes of packaging (for example, recyclability and biodegradability)

— expected primary use of packaging (for example, labeling and traceability to promote customer empowerment)

— packaging chain, from raw-materials sourcing to disposal, including collection and sorting schemes and reuse or recycling target setting

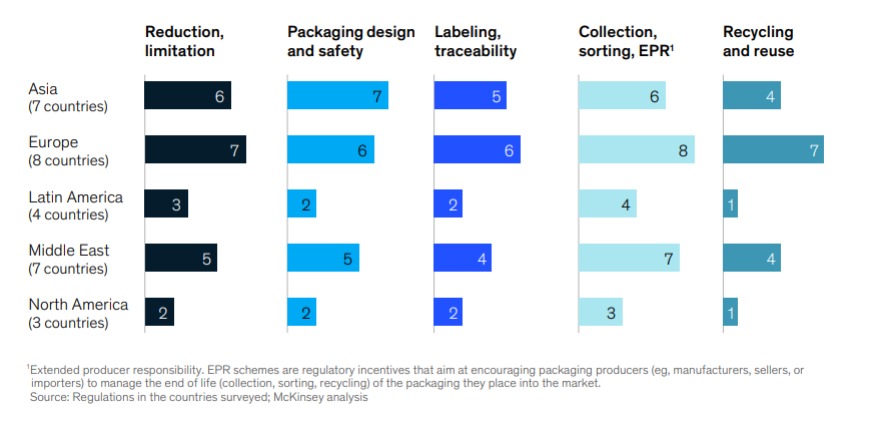

Countries have mostly embarked on their sustainability journey by addressing the start and the end of the flow—that is, the restriction of certain materials and a focus on waste management via extended producer responsibility (EPR). More advanced countries have set up infrastructure to support lasting changes in design, recycling capabilities, and recycled-content use (Exhibit 2)

— Twenty-eight out of 30 countries have collection, sorting, and EPR schemes and regulations in place or in development

— More than 40 percent of the 30 countries studied already have an EPR scheme in place.

Packaging-waste management is subject to the highest number of regulatory measures worldwide (91 in total). In addition, there has been an increasing regulatory focus on more specific areas of packaging, including the following:

Plastic packaging. In the past three years, sustainable-packaging regulations have tended to focus primarily on plastic packaging (versus other substrates). Eighty-three percent of the legal measures relating to sustainable packaging worldwide focus on plastics—with a total of 147 measures identified. The European Union and

Most countries surveyed worldwide are stepping up eorts to tackle packaging waste management

Prevalence of regulatory measures, by type

Asia have the highest number of regulations focusing on plastics, with France and India being the top countries in this respect

Beverage packaging. Regulations worldwide tend to have a relatively higher focus on beverage packaging than on other categories such as food and home personal-care packaging. However, there are noticeable regional differences:

— The European Union and North America focus more on beverages, with 50 to 60 percent of their regulatory measures having a specific endproduct scope targeting beverages.

Latin America and the Middle East focus more on food packaging.

— In the European Union and Asia, an emerging trend aims to tackle packaging across multiple product categories, reflecting a more holistic approach beyond a single focus area (such as beverages) to encompass a broader spectrum of end-use areas.

Primary versus secondary packaging. Regulations tend to focus on primary packaging all over the world, but a focus on secondary and tertiary packaging4 is more prevalent in Asia:

— Worldwide, nearly 90 percent of legal measures with a specific scope of packaging type tackle primary packaging alone or together with other packaging types (secondary, tertiary)

— China, India, Vietnam, and the Philippines are proposing regulatory measures that focus on secondary and tertiary packaging, while India has the most measures focusing on secondary and tertiary packaging. China has also shown an increasing focus on regulations around e-commerce packaging to minimize waste and leakage.

Regulatory vehicle for change. Our mapping reveals that financial penalties (versus subsidies) represent the main and preferred regulatory vehicle for sustainability change in the packaging industry: approximately 45 percent of legal measures

This mapping and rating of national strategy has enabled us to categorize the world according to four archetypes

implying a defined financial fallout refer to penalties—and these are generally related to taxes, fines, and fees. France uses incentives the most to encourage change in packaging sustainability (for example, via indirect premiums or indirect subsidies/funding5

Four archetypes identified

Most countries are moving toward setting up regulations around sustainable packaging, though at different paces and in various depths (Exhibit 3).

In order to better understand the developments on a global scale, we have developed a methodology to map countries along four key dimensions covering national strategy on sustainability ambition, time, scope, and maturity (Exhibit 4).

This mapping and rating of national strategy has enabled us to categorize the world according to four archetypes, from the least mature countries to the leading countries—those that are defining what sustainable packaging means.

Archetype 1. Unclear strategy with no targets or milestones and unstructured mechanisms to support sustainable packaging. This archetype (seven of the 306 countries we mapped, mainly located in North Africa, the Middle East and Southeast Asia) represents countries with limited regulations on this topic and where sustainable packaging is not the principal concern. Regulations have started to emerge in these countries, but they focus mainly on packaging-waste management. These countries typically do not present a holistic regulatory picture of packaging sustainability.

Seven out of eight European countries surveyed have launched regulatory initiatives focused on reduction or on recycling and reuse.