client: IMA DAIRY & FOOD

contact: Christopher Dale

Turchette Agency

(973) 227-8080 ext. 116

At Pack Expo, IMA DAIRY & FOOD to Highlight

Multilane FFS Machines for Sachets and Stick Packs, New Indexing Platform for Pre-formed Cups

Offering Endless Flexibility, and Enhancements to Portion Pack Equipment Line

New M-Flex Series of multilane form-fill-seal machines offer single-roll operation for expanded printing choices; New format flexible Indexing Platform for pre-formed cups; P-Series of portion pack machines combine precision, speed and ease of use.

IMA DAIRY & FOOD, whose equipment solutions comprise the long-established brands Gasti, Hamba, Hassia and Erca, will introduce new and recently enhanced packaging machines at Pack Expo, September 23-25 in Las Vegas. At Booth C-3200, the equipment provider will debut its M-Flex series of multilane form-fill-seal machines, its EFS – a new fill and seal machine for pre-formed cups, as well as two updated units in its P-Series line of portion pack machines.

Hassia’s form-fill-seal (FFS) M-Flex Series F600 Sachet Machine produces four-sided sealed sachets at a speed of up to 80 cycles per minute, and on as many as 16 lanes. Among other differentiators, the F600 offers single-roll functionality, an improvement over two-roll formats. The units run a single wide roll, which is located at floor level for easy changeover and front-and-back sachet registration – an option offering more printing choices than traditional two-roll machines. The F600 can handle rolls as wide as 1,200 mm with a diameter of 800 mm, which can yield up to 16 hours of run time between roll changes; the result is significantly reduced downtime and boosted productivity.

The F600’s careful product handling places a premium on quality assurance, and its CIP and SIP-suitable dosing units can be adjusted per specific product requirements. Exemplary filling accuracy and hygiene standards are assured, and the hermetic pack seal produced by the F600 is secure yet easy to open for consumer convenience.

The F600 is also flexible: A range of pack designs are possible, and sizes can be configured to align with production capacity. The machine’s control concepts are highly versatile, and include opportunities for integration with customer-specific systems. The unit can handle all common packaging materials suitable for heat-sealing.

At Pack Expo, Hassia also will showcase the other member of the M-Flex Series, the S600 Stick Pack Machine, a multilane FFS module for the production of three-sided stick packages. With a typical processing speed of up to 42,200 stick packs/h, the S600 can be designed to comply with customer/product-specific requirements.

Hassia also will showcase the P500 Portion Pack Machine, part of its P-Series line of FFS portion pack equipment. Capable of handling web up to 590mm wide at forming depths up to 40mm, the high-performance P500 is suitable for a broad variety of cup designs and materials, including PS, PET and PP. The unit offers maximum accuracy, precise product cutoff and gentle product handling.

A key benefit of the P500 is its use of comparably less packaging material. This is due to a combination of attributes, including its use of forming material of minimal thickness to avoid overpackaging; minimal punch waste from the low-waste punch unit; and volume-saving overlapping packing configuration for boxes and trays. Depending on the specific product, the P500 can achieve speeds up to 108,000 cups per hour.

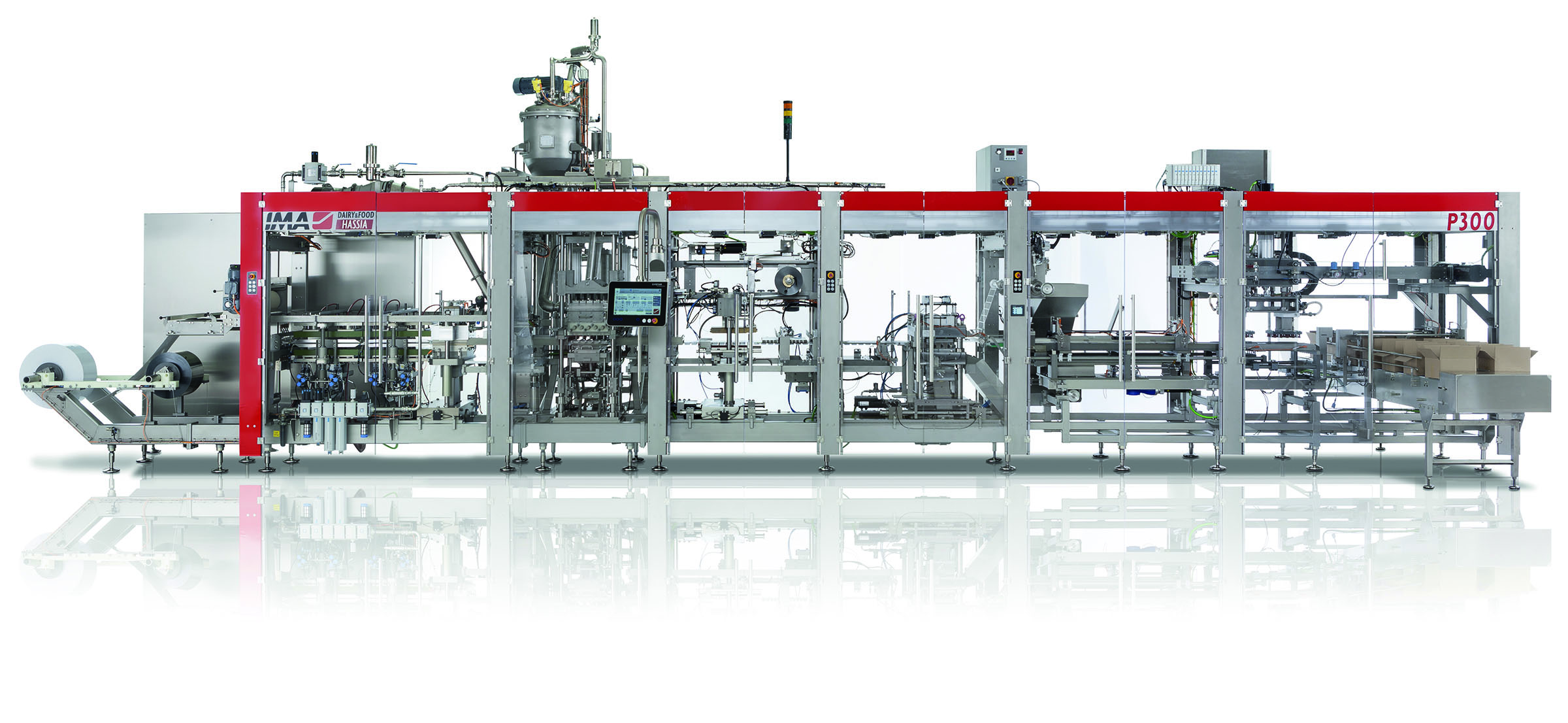

The P-Series of portion pack machines also includes the P300, and both units come into Pack Expo sporting new enhancements. The P300 features a new frame and guarding package for easier machine accessibility, and both the P300 and P500 offer hygiene levels up to FDA-filed, low-acid aseptic. Both also incorporate a new “cell board conveyor” discharge that controls round cups through case packing.

Erca will showcase the EFS, the recently developed new format flexible indexing platform for pre-formed cups. Utilizing new technology enhances the available options and ease

of operation and maintenance procedures. Modular in design with stainless steel construction and servo-operations, it allows for flexibility with filling stations, pre-fill and post fill for wet or dry ingredients. The chainless solution for cup transportation enables format flexibility and precision index positioning throughout the machine.

Capable of filling cups up to a diameter of 130mm, the EFS filling and sealing machine is suitable for a broad variety of products such as yogurt, fresh cheese, white cheese (curd), cottage cheese, single and multilayer desserts, aerated mousse products, deli salads, dips, dressings, hot filled sauces, soups, jams, fruit purees, tomato paste, sweet spread, baby food, pet food, etc.

Key benefits of the EFS are the format flexibility (quick release, tool free), the chainless drive (no chain stretch, no regular adjustment, less cup cassettes), the modular design and construction, the recipe functionality, the multi-fill possibilities (over track or remote fillers), and its improved hygiene options (UVC, Pulse light, H2O2). The machine will be available in hygiene levels Clean or Ultra-clean.

# # #

About IMA DAIRY & FOOD

IMA DAIRY & FOOD is one of the world’s leading suppliers of packaging machinery, technology and services and has extensive know-how in the key industries of dairy and food products. Based in Ranstadt, near Frankfurt, Germany, the holding company currently represents 3 production locations in Europe as well as numerous sales and service companies. IMA DAIRY & FOOD employs a workforce of about 500 worldwide.

IMA Dairy & Food USA serves the dairy and food industries with a portfolio covering nearly all areas of packaging machine application, including:

Filling and sealing machines (FS) for preformed cups and bottles, and forming, filling and sealing machines (FFS) for packaging products in the food, dairy, and beverage segments (filled up to the aseptic level), as well as wrapping machines for packaging butter, margarine, etc.

Aseptic vertical form, fill and seal machines for stick packs / pouches (with the corresponding dosing systems) as well as FS and FFS machines for packaging single portions of coffee, honey, jam, etc.

Piscataway, NJ – ACG Group, the only supplier in the world offering end-to-end manufacturing solutions for the pharmaceutical industry, has announced winners in the first-of-its-kind ‘Art in a Capsule’ competition. Initially launched in April of this year, the contest challenged aspiring artists to create miniature masterpieces – so tiny, in fact, that they could fit inside one of the company’s signature capsules.

Piscataway, NJ – ACG Group, the only supplier in the world offering end-to-end manufacturing solutions for the pharmaceutical industry, has announced winners in the first-of-its-kind ‘Art in a Capsule’ competition. Initially launched in April of this year, the contest challenged aspiring artists to create miniature masterpieces – so tiny, in fact, that they could fit inside one of the company’s signature capsules.